PROBATE & REAL ESTATE LAWYER

IN CORAL SPRINGS, FL

LEARN MORE ABOUT OUR PRACTICE AREAS

Probate is the term for the process of distributing all the assets of a person who has passed away. The system involves the courts, a judge, and many legal documents, and usually unfolds over a …

The Law Office of Gary M. Landau handles all aspects of a real estate deal for buyers or sellers. This can include drafting or reviewing a contract, examining title, holding escrow money…

Disputes about escrow deposits when a real estate deal falls apart are among the most common contract problems in real estate. The disputed escrow money must remain in the escrow account …

A Florida will is a legal document recognized by the courts that allows you to designate who will inherit your property, money, and other valuables. For people with minor children, a will is also …

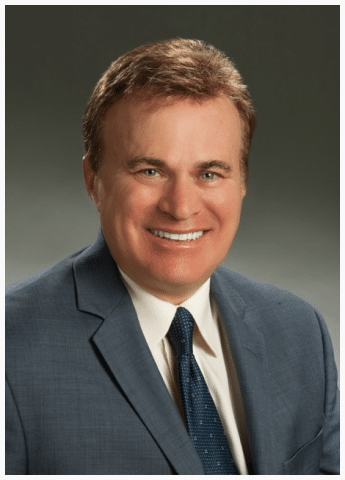

GARY M. LANDAU, ESQ

Why Choose Gary M. Landau

Gary Landau is a member of the Attorney’s Real Estate Council of Coral Springs. He was formerly a member of the Board of Directors of the Coral Springs Bar Association and is the former chair of the Real Property section of the Coral Springs Bar Association

Real Clients, Real Testimonials

Contact Us

Please fill out the short form below. We will usually respond within 1 business day but often do so the same day. Don’t hesitate, your questions are welcome.

*Required Fields

- Your Information Is Safe With Us.

Recent Blog Posts

Gary M. Landau Nominated Among Best Estate Lawyers by Leading Voting Platform

South FL Real Estate Law Firm Responds to Biden Administration’s Latest Program

Why Do People Refinance Their Homes in Florida?